Happy New Year to all!

It has been an amazing 2021 and to start off 2022, here’s my coverage on the expanding Terra universe…

Disclaimer: This is in no way financial or investment advice. Some of these protocols are not yet audited so please DYOR and experiment using a burner wallet. I will continue to update this as more protocols launch.

Now that I have sufficiently covered DeFi, the Terra blockchain & “TeFi,” and $UST - let us now turn our attention to $LUNA and the unique ecosystem that is being built on top of the blockchain.

Terra is a unique blockchain where it does not follow the common path for development like most other blockchains. The ultimate goal of Terra is the mass adoption of cryptocurrency so the focus is on end-users not just crypto natives - this is one of the biggest reasons why I swallowed the $LUNA pill. Terra started with payment solutions and a basket of stablecoins with Chai Payments in South Korea and Memepay in Mongolia. With the upgrade to Columbus-5 last October 2021, Terra has now started to scale by launching different DeFi protocols that can further this mass adoption.

Terra is a blockchain inside the Cosmos universe and with that comes Inter-Blockchain Communications (IBC) protocol which allows both fungible (cross-chain payments) and non-fungible token (NFT) transfers between various sovereign blockchains possible. Terra is also interoperable with some of the biggest blockchain ecosystems in crypto. It also connects with Ethereum, Binance Smart Chain, Solana, Polygon, Fantom, Avalanche, Near Protocol/Aurora and Harmony-One via cross-chain bridges.

Terra stablecoins and Luna

The protocol consists of two main tokens, Terra stablecoins ($UST, $SDT, $KRT, etc.) and Luna.

Terra stablecoins: Stablecoins that track the price of fiat currencies. Users mint new Terra by burning Luna. Stablecoins are named for their fiat counterparts. For example, the base Terra stablecoin tracks the price of the IMF’s SDR, named TerraSDR, or $SDT. Other stablecoin denominations include TerraUSD or $UST, and TerraKRW or $KRT. All Terra denominations exist in the same pool.

Luna: $LUNA is the native staking token of the Terra protocol and foundational asset for the entire ecosystem. It absorbs the price volatility of Terra stables. Luna is used for governance and in mining. Users stake Luna to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees.

LUNA has two core functions which are:

ensuring the price stability of Terra stablecoins through its role in collateralizing the mechanisms;

providing incentives for the platform’s validators that ensure the security of the blockchain.

The more Terra is used, the more Luna is worth.

If you want to learn more, you may read the documentation part in the main Terra website.

Key points

The ultimate goal of Terra is not to compete with other blockchains but to bring real-world use cases of cryptocurrency into people’s daily lives.

Terra is doing this by building the required legos that power and connect an economy that is truly decentralized.

And we have the applications to showcase this:

Developing payment apps: One example is Chai Payments in South Korea - a mobile app offering payment with lower fees when utilizing the advantages of blockchain.

Basket of stablecoins: Accelerating the adoption of Terra stablecoins by partnering with key players in many industries: e-commerce, travel & hospitality, etc.

Bridging traditional finance to the crypto world: Mirror Protocol provides easier access to the stock market by creating mAssets, which mimic the behavior of certain stocks/assets in the non-crypto markets.

As I’ve mentioned in my previous posts - $UST and the other basket of stablecoins under Terra are the main product of the ecosystem and $LUNA is the by-product of this adoption and success. As more and more protocols, applications, organizations, and users begin using $UST, $LUNA will continuously absorb the value from these transactions and activities which will then benefit the validators, delegators and holders of the $LUNA token.

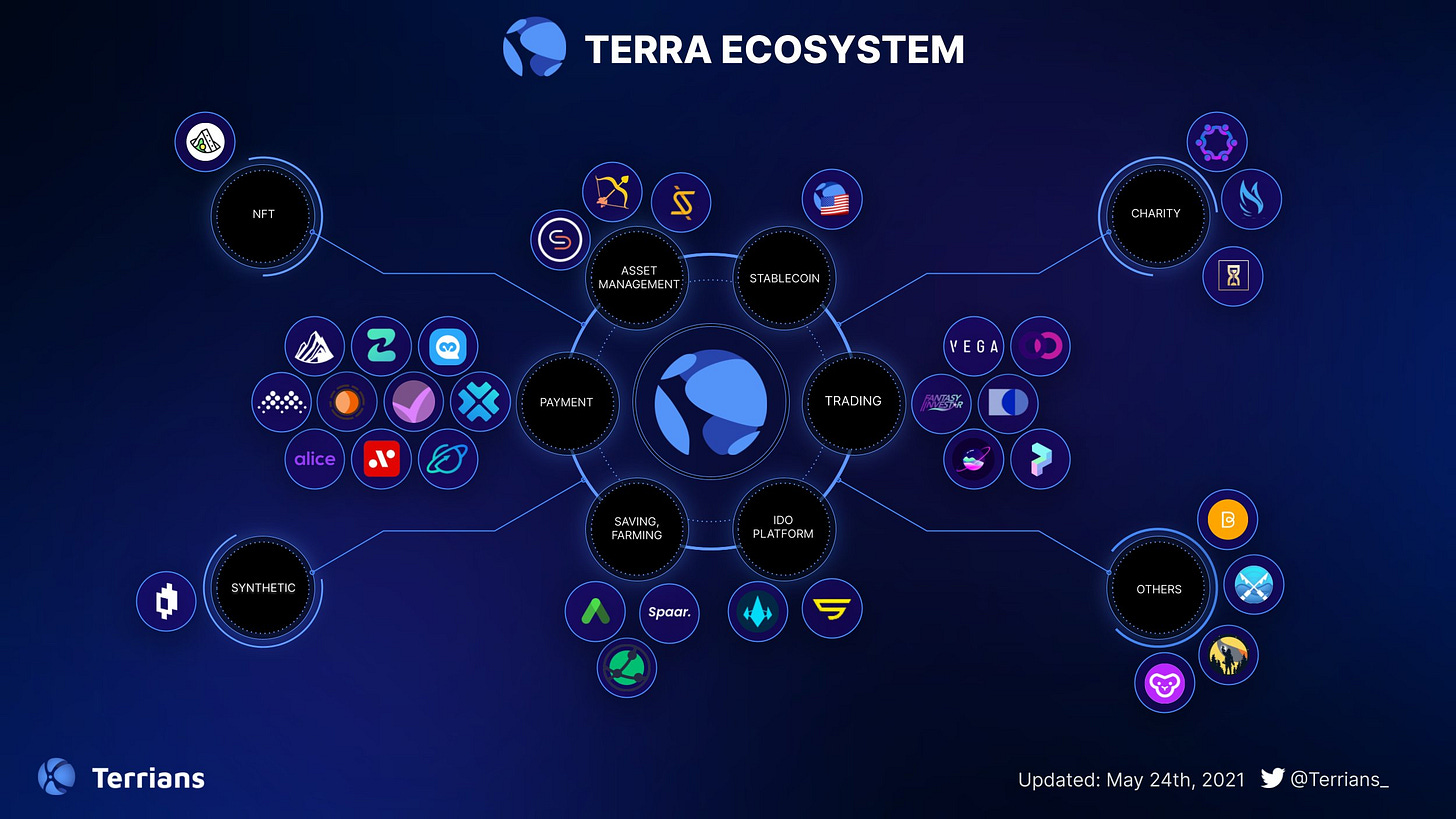

The Terra ecosystem includes several payment solutions and DeFi protocols (which I outline below):

May 2021

November 2021 (from 30 to over 100+ in a span of 4 months)

Payments (this is where Terra stablecoins got their first use-case)

Chai is an e-wallet for fast and cheap mobile payments in Korea, which has become one of the main growth drivers of the Terra ecosystem. According to Chaiscan, the wallet already has over 2.5 million users with $1.2 billion in payments per year. Users receive discounts for paying in KRT tokens. The Chai solution was integrated by leading e-commerce companies.

MemePay is an electronic wallet in Mongolia that uses MNT for payments which functions like Chai.

The Originals

Anchor Protocol (often referred to the Stripe for Savings) is an innovative decentralized savings protocol that offers a stable ~20% yield on $UST deposits. Launched in March 2021, Anchor is one of the most popular DeFi products on Terra, with a Total Value Locked of $9.24 billion as of January 3, 2022 according to DeFiLlama which makes it the 2nd biggest lending protocol to-date. The stable ~20% yield significantly exceeds the yield from lending on other platforms. Unlike other platforms, Anchor accumulates rewards from staking thanks to the Proof-of-Stake (PoS) mechanism to generate income. Critically, Anchor is not just a consumer-facing product — it serves other builders, too. With Anchor's open-source SDK, other crypto projects can easily integrate "Savings-as-a-Service" into their product. With 10 lines of code, a new crypto wallet developer could allow its user base to make the same ~20% return without needing to interact with Terra directly. Anchor doesn’t set a minimum deposit and has no lock-up periods. It generates the yield on deposits by lending out deposited assets to borrowers who put up collateral in yield-bearing assets. These assets, which Anchor calls “liquid-staked assets” or bonded assets (bAssets such as bLuna, bETH), represent staked native tokens on PoS chains. This means that the protocol has two revenue streams. One is the yield from the yield-generating collateral (deposits are over-collateralized, so there’s no risk for lenders), and the other is the interest rate paid by the borrowers.

Mirror is a DeFi protocol enabling the creation of synthetic assets called Mirrored Assets (mAssets) that mimic the price behavior of real-world assets like stocks or bonds - for example, blue-chip stocks like Amazon (AMZN), Google (GOOGL), Tesla (TSLA), and others. Users can purchase or mint and trade these synthetic assets, and also add them to liquidity pools. Theoretically, these assets could be almost anything: stocks, ETFs, commodities, and so on. In practice, it's focused on the first two of those, offering synthetic versions of Apple, Tesla, Alibaba, the iShares Silver Trust, Invesco QQQ, and others. Compared to other platforms, Mirror has a few clear advantages: it is open 24/7, there are no geographic boundaries, fractionalization is simpler, and transactions are faster. What regulators (particularly US regulators) do not like is by default Mirror is allowing anyone to own and trade stocks in a permission-less manner. But these mAssets do not confer equity in the companies nor do they provide dividends. As an illustration, users can mint mAssets by creating collateralized debt positions using either $UST or other mAssets as collateral—similar to how MakerDAO borrowers mint DAI. The newly minted mAssets are synthetics representing fractional shares of real stocks such as Apple (AAPL) or Google (GOOGL) tradable on Mirror or TerraSwap. Besides allowing users to mint and trade synthetic stocks, Mirror is especially attractive to liquidity providers because it provides relatively high-yielding market-neutral liquidity mining strategies.

Decentralized Exchanges (DEXes) and Automated Market Makers (AMM)

Astroport is the central space station of the Terra solar system, where travelers like you from all over the galaxy meet to exchange assets. The philosophy behind Astroport is simple and effective:

Enabling decentralized, non-custodial liquidity and price discovery for any asset.

As the ecosystem has grown, the need for an endemic AMM has expanded with it. In that respect, Astroport enters as a kind of Terra-native Uniswap or Sushiswap. It will provide typical AMM pools alongside stable swap pools and then potentially concentrated liquidity in the future. What makes Astroport really interesting for Terra is the fact that the main pairs will be based against UST. Meaning a large portion of the capital Astroport collects will increase UST supply and the Luna burn. Astroport not only brings new functionality to the Terra ecosystem but it will also increase demand for stablecoins like UST.

Local Terra: P2P exchange for Terra assets (like LocalBitcoins)

Loop Finance is building a decentralized exchange for trading Terra assets and NFTs. Loop is building an Automated Market Maker / Decentralized Exchange on Terra that will be integrated into a beta-stage, non-custodial crypto wallet primarily built for using crypto for daily use transactions through shopping in a way advantageous to small businesses and mainstream consumers. Loop Markets is an AMM DEX similar to TerraSwap’s AMM design that will list ERC-20 and Solana tokens alongside Terra’s native assets. It will enable a passive income for liquidity providers and also provide rapid swaps across Terra assets. LOOP will be the governance token will help in accruing shared trading fees, pools for tokens that currently do not exist on Terra will be incentivized with pool token rewards to help bootstrap liquidity. The project will launch a Chrome extension and mobile wallet application. Loop Wallet is a mobile, non-custodial wallet for shopping and merchant payments that will integrate Loop AMM, sourcing liquidity for payments via native swaps of Terra assets and stablecoins from the Loop DEX. It is currently in beta testing and will onboard new merchants with the launch.

Miaw Trader is a hobbyist’s DEX built on Terra.

Terraswap is the first decentralized exchange on Terra. It’s also an automated market maker (AMM) based protocol similar to Sushi or Uniswap, but it’s specifically built for swapping between native Terra and CW20 tokens on Terra. It is open-source software and fully decentralized protocol for automated liquidity provision on Terra for of users and DeFi applications.

DeFi applications

Anchor Protocol (see above)

Mars is a decentralized bank built on Terra. Developed as part of a joint venture between Delphi Labs, IDEO CoLab, Terraform Labs and other partners, Mars Protocol is bringing new financial services to Terra. Specifically, Mars will operate as an “interchain lending platform.” Managed by the “Martian Council,” Mars will offer new ways for lenders to receive interest on staked funds and open up assets to borrowers, both collateralized and un-collateralized. One of the Mars teams' major innovations is the introduction of “reactive interest rates,” meaning yields will respond to market conditions. Mars is being billed as the first general-purpose lending platform on Terra. Mars will enable leveraged long LP farming, bringing leveraged liquidity into the ecosystem while at the same time creating very attractive yield farming opportunities. In time, Mars intends to become a fully-featured, decentralized bank. Mars Protocol is building a money market for borrowing and lending on Terra. It’ll work similarly to how Aave or Compound work on Ethereum, only for Terra and Mirror assets on the Terra blockchain.

Kujira is opening Decentralized Finance to everyone, starting with liquidations. Be a killer whale and beat the bots at their own game. Bid on liquidated assets on Terra with Orca. Their vision is to be the cross-chain protocol for liquidations.

Levana is a project built on top of Mars Protocol by providing leverage to those wanting to ape harder. Essentially, Levana uses Mars to bring 2x leverage to Terra. Instead of just buying Luna, for example, users can purchase 2x Luna, which produces double the returns should the token increase in value. Over time, Levana intends to add leverage to all manner of assets, including index tokens. As with Mars and Astroport, it is being incubated by Delphi Digital. With 50% of tokens allocated to the community and treasury, Levana seeks to operate as a true DAO. Levana Protocol is a censorship-resistant, open-source leverage platform built on the Terra blockchain. It aims to provide leveraged trading services for assets on Terra by building a decentralized exchange.

Levana will provide users un-collateralized loan services through integration with Mars Protocol in its initial stage and subsequently implement a perpetual swap model. The vision of providing leveraged access to assets on Terra is a feature that will attract other apps to build on it. An economic model design which supports that will be crucial and that’s why Delphi is helping Levana with the design, whitepaper, and also financing the first round of the project.

Nebula is a revolutionary DeFi solution that allows users to create customized dynamic ETFs (clusters) and indexes that mimic the movement of multiple crypto assets. As its name implies, Nebula is bringing "clusters" of assets to Terra. Operating like ETFs, users will be able to buy into clusters that represent certain themes. A crypto ETF (exchange-traded fund) is a basket of crypto assets traded between users on a decentralized/centralized platform. Not only does it provide the benefits of individual assets, but it also offers a way to reduce idiosyncratic risk through diversification.

Orion Money's vision is to be a cross-chain stablecoins bank - the best place in DeFi for stablecoin saving, lending, and spending. Orion Money is built on top of Anchor Protocol. Through Orion, users can access ~20% APY on any stablecoin. That means you could deposit Tether, USDC, DAI, or UST onto the platform and receive the same returns. Orion also offers ways to protect your principal investment through insurance products. Orion is an Ethereum-based protocol that integrates with Anchor Protocol on Terra via the EthAnchor cross-chain bridge. It allows Ethereum users to earn fixed interest rates on Ethereum-native stablecoins like wUST, DAI, USDT, USDC, FRAX, and BUSD. Behind the scenes, Orion exchanges these stablecoins for wrapped UST (wUST) and deposits them into Anchor Protocol for the Anchor UST rate. When users want to withdraw their deposits, Orion automatically reverses the process or unstakes the UST on Anchor, converts it into the desired stablecoin, and deposits it back to the user’s Ethereum wallet. The current fixed yield rates on Orion range between 13.5% and 16.5% for different stablecoins, which is slightly below the ~20% Anchor rate. However, the yield rates are among the highest offered for stablecoins on Ethereum.

Ozone will operate as a marketplace in which participants can buy and sell insurance coverage. In particular, these insurance products are designed to cover “technical failure risks in the Terra DeFi ecosystem,” according to Do Kwon. Essentially, if for whatever reason an error occurs such that a user could not access their Luna or UST, Ozone would compensate for potential losses.

Prism empowers users with new opportunities by creating a new marketplace to trade Principal & Yield Tokens. Though yet to go live, Prism is arguably Terraform's most innovative product. Through the new protocol, users will be able to "refract" assets into a principal component and a yield component. For example, Luna could be split into pLuna, representing the principal, and yLuna, marking the yield. Splitting assets enables new use cases. For example, someone in need of liquidity could sell the future yield of their asset, or yLuna. Equally, someone could decide they want a yield-generating asset with no underlying risk of liquidation, and purchase pLuna. In effect, Prism creates tooling for interest rate swaps.

Sigma is bringing options trading to Terra. Sigma provides users with the ability to mint and trade collateralized options.

Spar is building a decentralized active fund management protocol on Terra using Mirror. The protocol will allow money managers to show off their skills and retail investors to invest alongside them. Spar is aiming to offer casual investors returns that are usually reserved for private funds while providing professional investors with the ability to manage their own funds. Think of Spar as a decentralized hedge fund pool, where isolated liquidity pools of depositor assets rebalance and adjust based on the pool manager’s specific investment strategy or long-term thesis. There are primarily two participants — Investors & Pool Managers. Spar mainly caters to investors looking for passive investment opportunities with more control or who want exposure to higher rates of return but are unable to trade. Investors are presented with an easy interface that allows them to view their overall investment performance, track the pool manager leaderboard, and select a pool to deposit funds. Investor assets receive the returns generated by the pool’s performance, with their return proportional to the amount invested relative to the overall pool size. There are no restrictions on deposits or withdrawals. Once a user deposits capital into a pool, the manager deploys the capital to generate returns based on their strategy — the overall risk/reward for users transparent upfront. Since Terra and Mirror power Spar, investors can gain exposure to various asset classes within specific pools, including equities, commodities, ETFs, and more. Pool managers can even deploy the investor capital as an LP in DeFi protocols — generating passive returns from yield farming strategies.

Stader Labs aims to be an infrastructure platform for staking and other potential applications that can be built on staking. In the short term, they are building a simplified staking and liquid staking platform for Terra and Solana.

Vertex Protocol will establish the first facility for crypto FX trading on Terra, powered by perpetual swaps.

White Whale gives users a way to arbitrage dislocations in UST pricing automatically. By making this kind of activity accessible, White Whale can bring more participants into Terra's ecosystem and effectively “decentralize the enforcement of the peg.” It seeks to empower retail investors to keep the UST peg via L1 seigniorage arbitrage as well as participate in other complex automated trading strategies through a simple user friendly experience.

Other DeFi Utilities | Real World + DeFi

Alpha DeFi is your trusted digital asset manager, secured on Terra.

Aperture Finance will allow for cross-chain investments that are easy for the common user.

Ariel Money is a decentralized protocol that offers perpetual contract trading. People would be able to take a leveraged long or short position while being fully in control of their own funds. Positions would be automatically balanced by the dynamic funding rate. Ariel Protocol uses the Virtual Automated Market Makers (vAMM) model to facilitate price discovery.

Altered Protocol is a synthetic commodity-money with near-perfect supply elasticity on Terra.

Bitlocus is a DeFi investments platform for fiat-based investors.

Brokkr is an investment platform for simple and optimized DeFi investing.

Digipharm is a value-based healthcare platform built on Terra.

Edge Protocol is building what they refer to as the Airbnb for Banking. Lend, borrow collateralize your assets in your beloved markets.

Hedge Plus is a protected mAsset Strategy built on Terra.

Kinetic Money will allow auto-repaying loans on Terra; granting you access to your future yields today.

Leserve DAO is a decentralized, reserve currency on Terra.

Lighthouse DeFi is part of the Original Harpoon Protocol, separated ways and rebranded to Lighthouse DeFi. Offering a soon to be released platform for liquidations.

Mirror Market is building a platform for insightful + comprehensive market information with real-time dashboards, serving the community and the ecosystems of Terra and Mirror Protocol..

Neptune Finance is building liquidation-protected leverage yield farming for the Terra blockchain. Users will be able to support and farm their favorite Terra dApps by staking $bLuna, $bEth, $bSol.

Nexus Protocol operates advanced yield strategies on Mirror and Anchor. Critically, it's designed to eliminate the risk of principal liquidation. Jason Hitchcock highlighted its potential to increase demand for UST and drive higher returns.

Riviera Capital is an asset management firm bridging the gap between traditional finance and the cryptocurrency world. With a focus on, but not limited to, the Terra ecosystem we aim to provide alpha in all things DeFi.

Terraland is a global transaction platform based on blockchain technology for the commercialization of real estate, built on the Terra blockchain.

TIX is the most advanced decentralized ticketing platform. Built for artists, venues, events, and more. Built by fans. Built on Terra.

Whirlwind Finance bills itself as a cross-chain liquidity firehose.

World Series of Options (WSO) is bringing gamified, limited risk options trading to Terra.

Yield Foundry DAO is building the next generation of smart, community-owned, structured vaults on Terra.

Recurring Payments, Marketing, Related Activities

Artemis Pay is building a platform for sending and receiving any crypto to friends & family easier than ever before.

Astral Money is building a platform for payments using $UST.

Elevate Protocol is building the marketing tools for a decentralized world on Terra to help applications scale.

PaywithTerra is an automated information service that works by utilizing publicly available information on the Terra blockchain. It provides machine-readable notifications for e-commerce websites when payment transactions are detected.

Suberra makes it easy for businesses to accept recurring payments in stablecoins.

Valkyrie is a dApp activation protocol designed to help protocols launch effectively. Protocols can create campaigns offering social referral rewards. Users can participate in the project and be exposed to new projects and be incentivized to experiment and also refer the campaigns to others. Valkyrie allows any user to design a ‘campaign’ with a specific target goal and disseminate pre-allocated rewards to users depending on their level of participation. This ‘rewardable ecosystem’ consists of campaign creators, who have an objective to increase user-ship of their project on the Terra network, campaign participants, who participate in the campaign and share content to other users, and campaign referrers, who spread the campaign content to new users. Valkyrie provides a generalized framework empowering individual teams to apply it to their specific campaign needs.

Yield Farming

ApolloDAO is a yield aggregator on Terra. Yield Aggregators are protocols which optimize rewards from DeFi yield farming for maximum efficiency by auto-compounding them. ApolloDAO takes this one step further by introducing the ApolloDAO Warchest. The Warchest is an actively managed fund governed by $APOLLO holders. The first decentralized asset management fund built on Terra.

Spectrum is the first decentralized yield optimizer platform on Terra. It works similarly to other Ethereum-native aggregator tools like Yearn Finance, Vesper Finance, and Harvest Finance. Spectrum optimizes user’s yield farming by auto-compounding their rewards from various liquidity pools or other yield farming products built on Terra. Spectrum’s current flagship product is the Vaults, where users can stake their assets and choose between two gas-saving strategies: auto-compounding and auto-staking. With auto-compounding, the vaults automatically increase the deposited token amounts by compounding the yield farming rewards back into the initially deposited liquidity pools. With auto-staking, the vaults automatically stake the rewards into the respective governance staking contracts.

Neobanks and E-Commerce

Alice Finance is building a user-friendly mobile front-end application deriving fast payments and offering access to high-yield from DeFi protocols built on Terra. The product will primarily cater to non-crypto native users, allowing them to connect their bank accounts, purchase Terra currencies, earn high yields by leveraging Anchor, and spend $UST using the project’s debit card.

Beema Finance allows you to earn a high, stable yield powered by decentralized finance and easily spend the profits.

Burst is building a DeFi powered bank for Gen Z users.

Capapult: Financial savings for Scandinavia powered by Terra.

Glow is a programmable yield ecosystem built on Terra. We're building a world of yield focused dApps to make $UST the currency of the internet.

Kado is building channels for anyone to spend their $UST and other Terra stablecoins.

Kash DeFi is Terra-powered app for payments, savings and investments.

Outlet Finance bills itself as the bank account replacement powered by DeFi.

Sayve Protocol is a savings and earning protocol built on the Terra blockchain, with an AI-powered Learn to Earn mechanism.

Spaar NL is bringing high yield savings to The Netherlands.

Stablegains allows you to earn on your stablecoins.

Tiiik Money is Anchor Protocol-based savings app dedicated for the Australian market.

Yotta is developing an Anchor Protocol-based savings option for the US.

Launchpads

Atlo refers to itself as “The People's Launchpad.” A.T.L.O. is a space industry acronym for Assembly, Test and Launch Operations. Atlo is a launchpad where all decisions are made through community governance. Builders engage with a committed, informed and liquid community dedicated to supporting great ideas. Investors decide what gets launched.

Pylon Protocol is a suite of DeFi savings and payments products powered by yield redirection built on Terra. It is also a launchpad for projects on Terra. It is a yield redirection protocol that builds on stable, yield-bearing protocols like Anchor. It allows users to make safe or retrievable deposits to pay for different services or invest in projects. Instead of risking capital and purchasing or investing in things with direct deposits, Pylon users can leverage Anchor to redirect their yield towards any purpose they see fit. For example, instead of making a risky investment in a crypto startup through an Initial DEX Offering (IDO), Pylon users can make retrievable deposits whereby they only invest the yield instead of the principal. Instead of investing capital, users lock up yield-bearing capital and redirect the yield towards the investment. This way, users reduce their risk and the projects can still raise capital from a recurring revenue stream gained from the delegated yield.

Pylon Gateway, a token launchpad and crowdfunding-via-yield platform and also Pylon Protocol’s first product which enables users to make investments at no loss by depositing Terra’s algorithmic stablecoin $UST to a pool in return for project tokens, governance rights and other perks. What sets Pylon apart is that it enables users to withdraw their full principal after the pledged vesting period to claim project tokens and other corresponding rewards. $MINE is the native governance token with the name inspired by Starcraft’s minerals as with Pylon’s namesake, built with a high yield capturing mechanism for all forthcoming integrations on Pylon Protocol and Pylon Gateway.

Starterra is the the first gamified launchpad on Terra. StarTerra is the first gamified launchpad with a unique combination of guaranteed & lottery based prize pools.

TerraFormer bills itself as the World Engine for the Terra Ecosystem. It is a liquidity stack for startups during all stages of growth, across asset classes.

Thorstarter is a multichain Venture DAO and IDO platform that combines a unique launchpad model with liquidity grants to incubate, fund, and launch the most promising projects across DeFi.

Privacy

Terra Bay allows users to grant themselves anonymity. Since it is a decentralized protocol, the user, and only the user, has complete control over their money.

Void is a protocol that gives users control over financial anonymity, as an opt-in financial privacy service. By depositing fixed amounts in the contract, waiting, then withdrawing to a brand new wallet, funds will be untraceable back to the original wallet. Void Protocol will operate in a completely decentralized manner, this offers major benefits in terms of security, transparency and peace of mind for the users. In time the protocol will operate under full control of the Void DAO.

Charity | Doing Good

Angel Protocol is Terra’s charity protocol which aims to challenge some of the existing paradigms of the charity world. “Give once, and give forever” is the premise of Angel. Leveraging Anchor's yields, Angel makes it easy for charities to set up endowments with high returns. Donated funds can continue to produce meaningful yields indefinitely. One of the major challenges of the charity world is sustainability. The market plays a decisive role in affecting the seasonality of the charities. And when it comes to making a difference, charity has to be perpetual. The existing problem with most non-profit organizations is the operating revenue and Angel Protocol aims to provide a solution by turning charity contributions into perpetual charity endowments. The amount pledged ends up earning yields and those yields become a perpetual source of charity. Simple enough! The beauty of Terra ecosystem is the seamless integration of different protocols with one another. Angel Protocol allows donors to make a pledge through $UST, which is an algorithmic stable coin pegged to the dollar’s value. It is created by buying and burning an equivalent amount of LUNA in the market. Angel Protocol uses Anchor Protocol to earn a high yield fixed interest of nearly ~20%. Anchor Protocol is Terra’s high-yield fixed interest savings protocol; the yield earned is periodically given to the charity as per the donor’s choice. Angel Protocol not only provides a benefit to charities, donors and donees but to the entire Terra ecosystem. With the increased adoption of $UST by charities, more LUNA will have to be bought and burned for the minting of $UST. This will lead to less supply pushing the prices up and thus benefit the $LUNA holders.

Sandclock is an insured multi-chain, cross-chain aggregator with a vault architecture that allows for saving, donating, and investing.

Subsidium Digital is committed to providing charitable solutions including tax incentives for DeFi investors.

Platforms/Applications for Gaming, Metaverse, NFT & Related Activities

(I will discuss Games and NFT projects in a different post.)

Andromeda Protocol: Building the WordPress of blockchain applications.

BetTerra is a GameFi betting platform designed to do good.

Duel Dojo is a decentralized gaming hub built by gamers, for gamers. By leveraging stable yield generation and NFT technology, our platform creates an in-game economy that spans across more than just an individual game.

Fanfury is a decentralized fantasy sports platform that brings trust-less play-to-earn gaming to everyone.

Forge Protocol reimagines NFTs on Terra.

Ink Protocol is first decentralized prize savings game on Terra.

Knowhere Art is the first NFT marketplace on Terra.

Loterra is a decentralized lottery platform built on the Terra blockchain.

Luart is the first gamified NFT marketplace on Terra.

Lunaverse is a virtual world built on the Terra blockchain. NFT properties linked to yield bearing deposits on DeFi protocols. It is where the digital world meets the real world.

Mavolo Money is lossless principal yield-based payments platform. Imagine a wishing well where your wishes can come true. Enter Mavolo; Create a wishlist, drop your coins in the well and with a little patience, your wish is granted. Best part is, leave your coins in the well to generate the wishes faster. Or you can pull them whenever you want.

Minerva is a DAO platform which will bring appreciating wine investments to users directly on the Terra blockchain. The DAO will select and verify providers of wine, who will be authorized to publish ADOs as proof of sale. Users will be able to use their ADOs as collateral, earning yield on wine as a primary market. When users wish to collect their wine bottles in physical form, the ADO will be burned after proof of delivery, with both artwork and part of the yield retained by users.

NFTerra is a community oriented hackathon for improving NFTs on Terra.

Nusic is building music-backed currencies.

OnePlanet is a new land to build NFTs on Terra.

Orne is building a platform where NFTs are used for sustainable forestry.

Pilgrim Protocol will allow for atomic price curves for NFTs with zero liquidity requirements.

Pixy Fund is a crowdfunding platform that empowers artists and users. Purchase principal protected NFTs & fund innovative digital media projects on the blockchain.

Playible: Gamified NFTs coming to Terra. Collect once, play forever in lossless fantasy sports contests. Formerly Fantasy Investar.

Pluto’s Pot is building a gamified charitable raffles dApp on Terra.

Preserver Protocol harnesses Anchor Earn yield to create perpetual prize pools for your favorite games and perpetual donations to your favorite gamers/creators.

Random Earth is a NFT marketplace on Terra.

Rerun is an app that motivates you to build habits by paying you crypto rewards.

Talis is the first DAO NFT marketplace and POD shop.

Terra Casino is a DAO one stop shop for gamified everything Gambling/ Betting on Terra. You can expect to find games like slots, poker etc.

Terra Vegas is a decentralized casino on Terra.

Terra World is the First NFT Metaverse for Work platform. Terra World is a metaverse for working service powered by Terra, providing a distinct remote work environment for business.

Tsunami Protocol: Content NFT market & storage solution making waves multi-chain.

Others

BreachGG is GameFi ecosystem transforming gamers' online identity into a Metaverse Avatar that levels up from dueling, socializing, matching

Hermes Protocol is building a platform for Notifications/ Integrations/ Communication Services for the Terra ecosystem (and Cosmos-based chains later).

Hypernova is Terra’s Job Board.

Lunar Assistant is a Discord bot that helps with the community management of NFT communities on the Terra blockchain. Quickly set up NFT community voting, private channels for those with certain types of NFTs, and public whitelists for mints.

Nova Protocol aims to bring stability to the blockchain.

Terra Cards sells digital gift cards and accepts $UST as payment. Now you can shop at your favorite stores with your TerraUSD.

Wallets, Domain Name, Dashboards & Others

Terra Station Wallet (other wallet extensions at https://www.terra.money/)

Events

If you want to think about $LUNA’s potential valuation, think about the demand for $UST and the other Terra stablecoins. Anchor is for savings, Mirror is for investments, Chai is for payments and Terra is for currency. $LUNA burns during Terra stablecoin expansions and prints during stablecoin contractions. A bet on $LUNA is a bet on the widespread adoption and growth of the Terra stablecoin ecosystem.

More than any other project, Terra is positioned to take crypto mainstream. To bring its particular benefits to those that have no interest in understanding what is happening under the hood. With Chai, it has already proven its ability to do so; its newer products open a dizzying set of possibilities, an infinite, expanding set of ways to arrange the platform's “money legos.”

For a listing of Terra projects, you may also refer to SmartStake’s listing at https://terra.smartstake.io/projects.

Very good article even though you missed LUNI.

Really helpful. Thank you!